You will also need to verify your identity. This is a significant sum, but it is less than what you would have to deposit to trade with some other brokers. This rule applies across the board for all Thinkorswim accounts, regardless of the type. You do need to make an initial minimum deposit of $3,500 to get started. This involves filling out a few screens of basic information, agreeing to the terms of service, creating your account and setting a password. If you want to use Thinkorswim, you need to open a margin account. Backed by the TD Ameritrade name, the Thinkorswim brand is now stronger than ever. With so many years to roll out tools and benefits, Thinkorswim has become one of the most intuitive and feature-rich platforms available to traders on the web. By the time TD Ameritrade purchased Thinkorswim in 2009, the value of the platform was about $606 million.Īs mentioned before, you can trade far more than options on Thinkorswim today. As of the year’s end, client assets totaled to nearly $2.6 billion. The platform achieved a milestone in 2007 when it generated $318 million in revenue. Through the years that followed, Thinkorswim was affected by quite a few different acquisitions and mergers. That year the platform was established, initially just for options trading. The history of Thinkorswim dates all the way back to 1999. One of the reasons to choose Thinkorswim is the platform’s reputation.

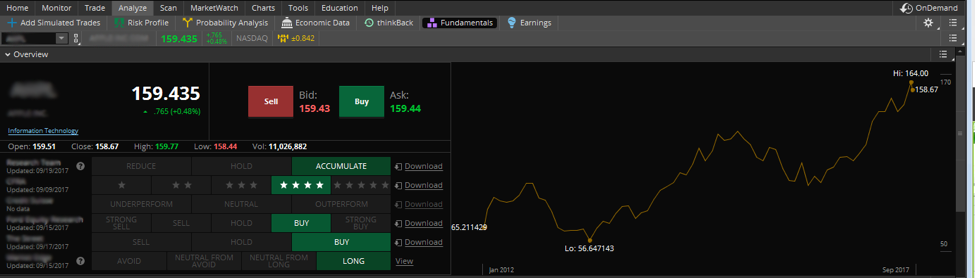

The platform can be used to trade numerous different assets including equities, mutual funds, exchange-traded funds, futures, bonds, and foreign exchange currencies.Ĭonsidering trading forex on Thinkorswim, but not sure yet if you want to take the plunge? In this article, we will teach you everything you need to know about this platform, so you can decide if it is the right fit for you. Originally it was a product of Thinkorswim Group, Inc., but in 2009 it changed hands and is now a service of TD Ameritrade. One of the most pop ular trading platforms around is Thinkorswim.

0 kommentar(er)

0 kommentar(er)